139

AirAsia X Berhad • Annual Report 2014

NOTES TO THE FINANCIAL STATEMENTS

AS AT 31 DECEMBER 2014

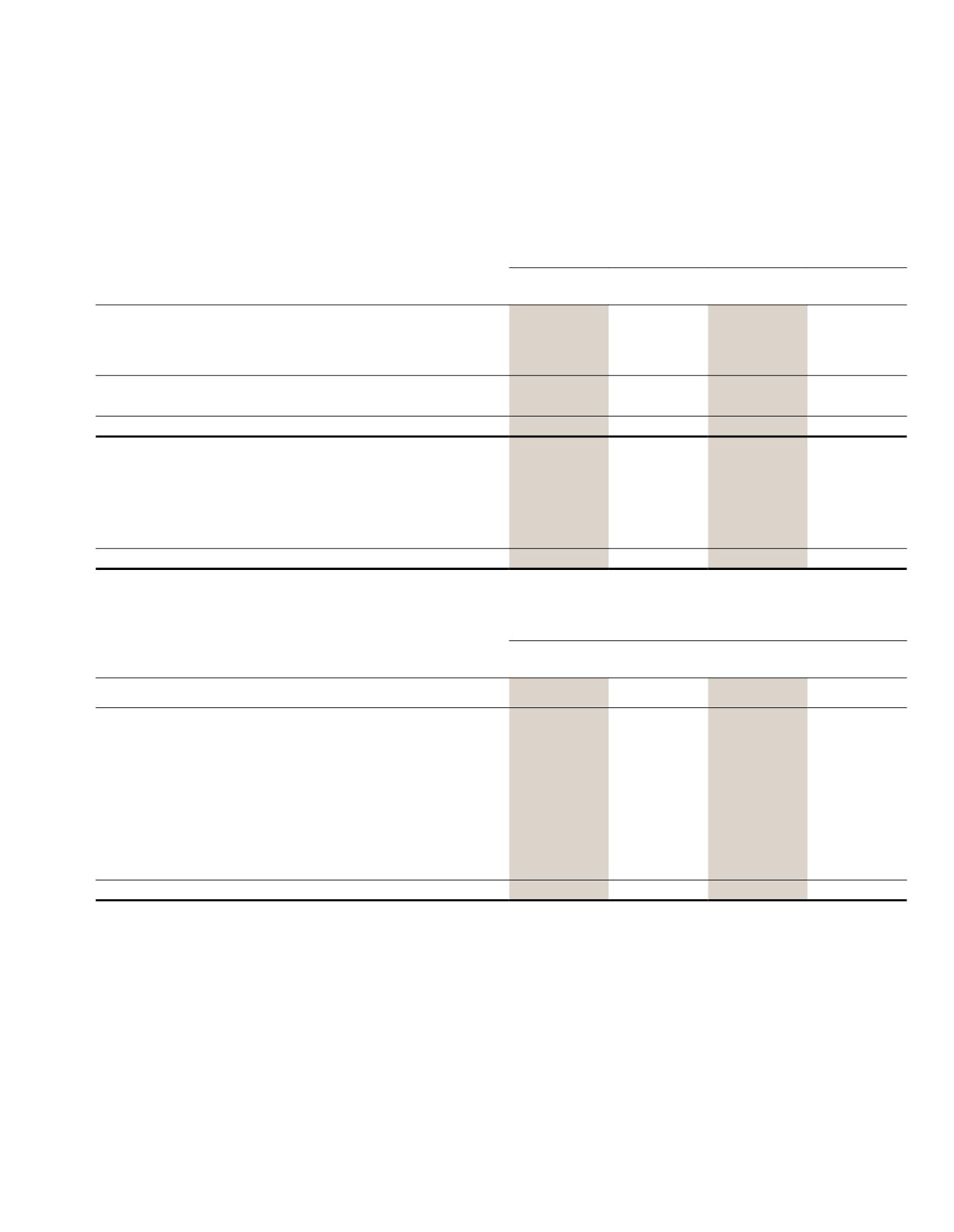

10 TAXATION

Group

Company

2014

RM’000

2013

RM’000

2014

RM’000

2013

RM’000

Current taxation:

- Malaysian taxation

71

727

71

727

- Foreign taxation

174

270

-

-

245

997

71

727

Deferred taxation

(86,163)

(124,790)

(86,163)

(124,790)

Total tax credit

(85,918)

(123,793)

(86,092)

(124,063)

Current taxation:

- Current financial year

245

997

71

727

Deferred taxation: (Note 13)

- Origination and reversal of temporary differences

(86,163)

(124,790)

(86,163)

(124,790)

(85,918)

(123,793)

(86,092)

(124,063)

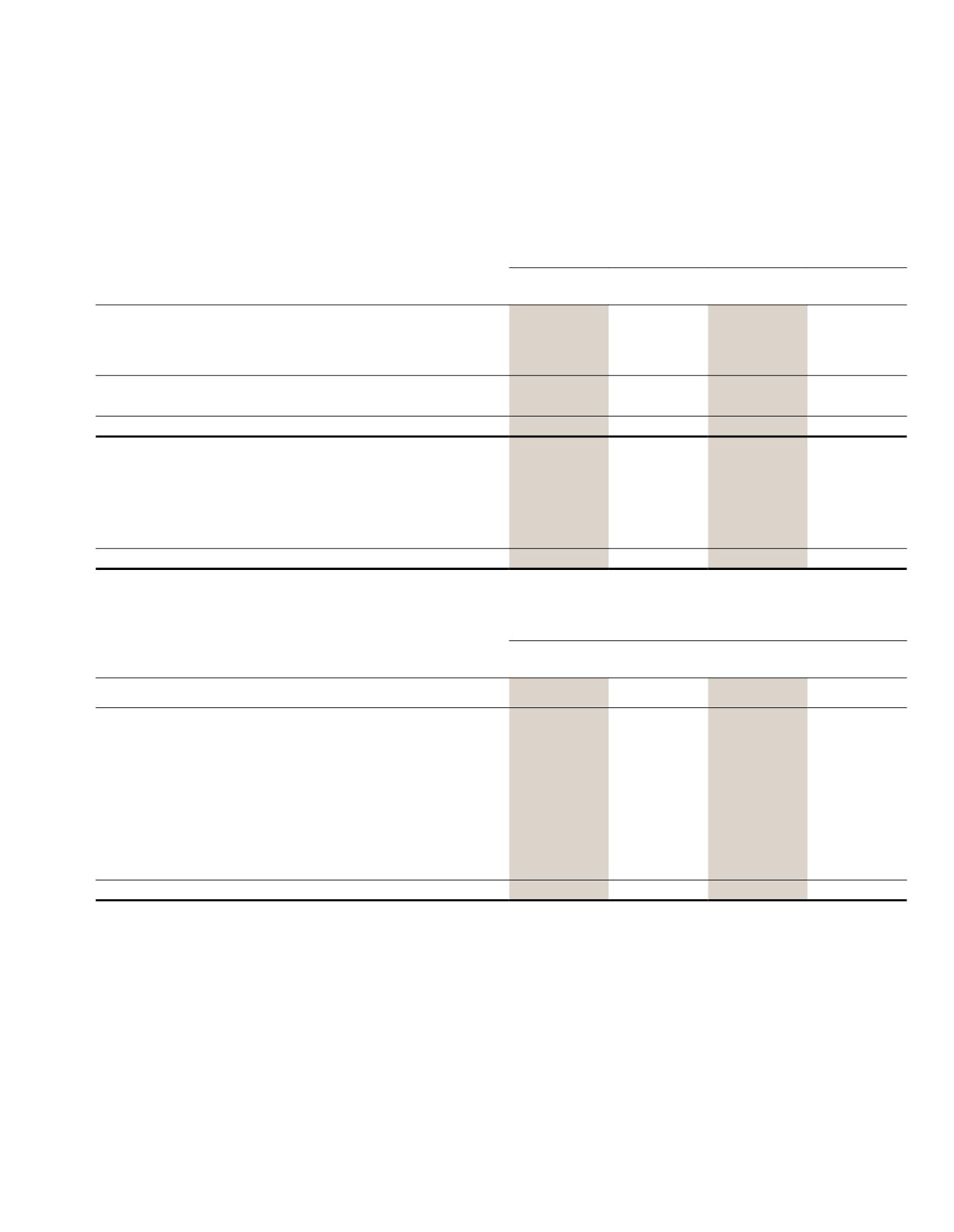

The explanation of the relationship between taxation and loss before taxation is as follows:

Group

Company

2014

RM’000

2013

RM’000

2014

RM’000

2013

RM’000

Loss before taxation

(605,361)

(212,060)

(570,095)

(212,142)

Tax calculated at Malaysian tax rate of 25% (2013: 25%)

(151,340)

(53,015)

(142,524)

(53,035)

Tax effects of:

- clawback of tax incentives/ (tax incentives)

34,202

(111,744)

34,202

(111,744)

- expenses not deductible for tax purposes

51,681

30,176

51,651

30,052

- income not subject to tax

(34,217)

-

(34,217)

-

- changes in statutory tax rate

4,796

10,664

4,796

10,664

- share of results of an associate and a joint venture

8,960

126

-

-

Taxation

(85,918)

(123,793)

(86,092)

(124,063)