149

AirAsia X Berhad • Annual Report 2014

NOTES TO THE FINANCIAL STATEMENTS

AS AT 31 DECEMBER 2014

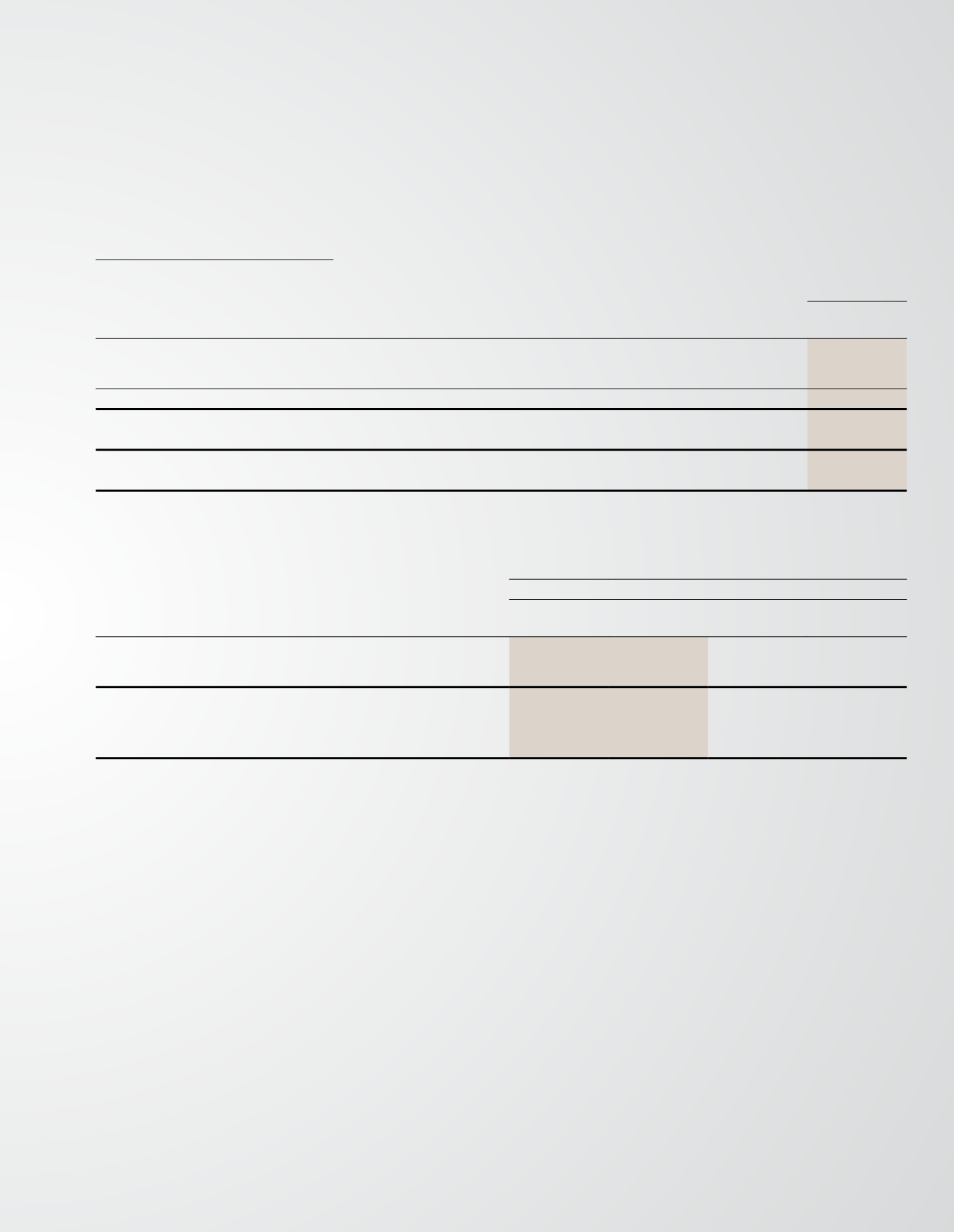

18 INVESTMENT IN A JOINT VENTURE (CONTINUED)

Reconciliation of summarised financial information

IAAX

2014

RM’000

Opening net assets at acquisition date

109,976

Loss for the financial year

(33,310)

Closing net assets at 31 December

76,666

Interest in joint venture (49%)

37,566

Carrying value at 31 December

37,566

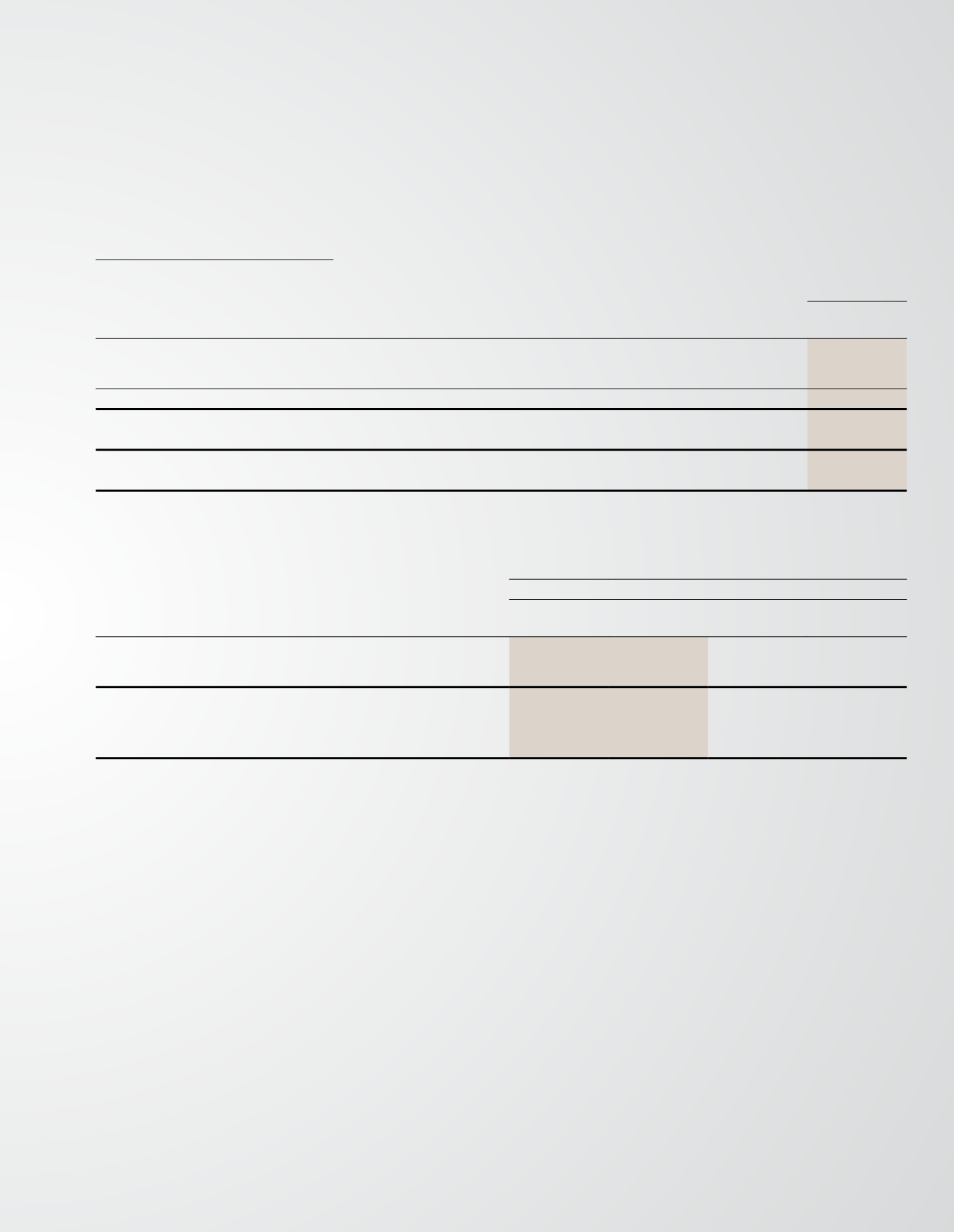

19 DERIVATIVE FINANCIAL INSTRUMENTS

Group and Company

2014

2013

Assets

RM’000

Liabilities

RM’000

Assets

RM’000

Liabilities

RM’000

Non-current

Forward foreign exchange contracts – cash flow hedges

-

-

60,388

-

Current

Commodity derivatives

- held for trading

-

(102,993)

5,541

-

The full fair value of a hedging derivative is classified as a non-current asset if the remaining maturity of the hedge item is more than 12 months and, as a current asset, if the

maturity of the hedged item is less than 12 months. Derivatives held for trading are those which do not qualify for hedge accounting.

(i)

Forward foreign exchange contracts

The notional principal amounts of the outstanding forward foreign exchange contracts at 31 December 2014 were nil (2013: RM741.1million).

During the financial year 2014, the Group has terminated all cross currency interest rate swaps (“CCIRS”). The hedging instruments are derecognised from balance

sheet and any cumulative gain or loss existing in equity at that time is reclassified to income statement.

(ii)

Fuel contracts

The outstanding number of barrels of Singapore Jet Kerosene derivative contracts at 31 December 2014 was 1,957,597 barrels (2013: 187,778 barrels). The Group

entered into Singapore Jet Kerosene fixed swap contracts with AirAsia Berhad during the financial year ended 31 December 2014, where the contracts are classified

as derivatives held for trading.