154

AirAsia X Berhad • Annual Report 2014

NOTES TO THE FINANCIAL STATEMENTS

AS AT 31 DECEMBER 2014

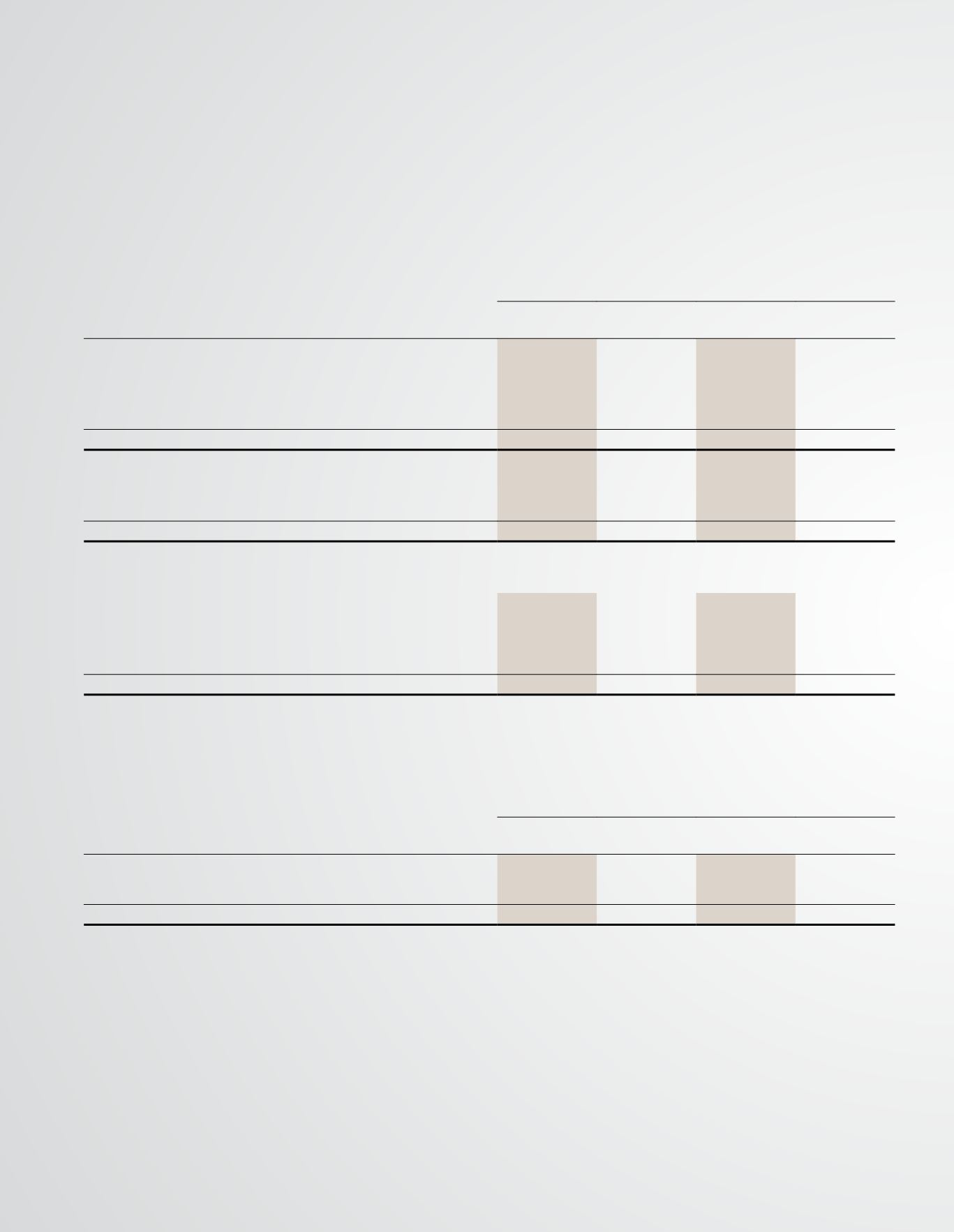

22 AMOUNTS DUE FROM / (TO) RELATED PARTIES, AN ASSOCIATE, A JOINT VENTURE AND SUBSIDIARIES

The amounts due from/(to) related parties are in respect of trading transactions. The normal credit terms of the Group and Company range from 30 to 60 days (2013: 15 to 60 days).

Group

Company

2014

RM’000

2013

RM’000

2014

RM’000

2013

RM’000

Amounts due from related parties

38,769

16,387

38,304

16,325

Amount due from a joint venture

19,499

-

19,499

-

Amount due from an associate

5,314

1,353

-

1,353

Amount due from a subsidiary

-

-

5,314

-

63,582

17,740

63,117

17,678

Amounts due to related parties

(23,173)

(1,916)

(23,173)

(1,916)

Amount due to an associate

(196)

-

(196)

-

Amounts due to subsidiaries

-

-

(1,896)

(1,887)

(23,369)

(1,916)

(25,265)

(3,803)

The currency profile of amounts due from related parties, joint venture and a subsidiary are as follows:

Ringgit Malaysia

36,394

15,764

36,394

15,764

Australian Dollar

581

62

116

-

US Dollar

26,085

1,529

26,085

1,529

Others

522

385

522

385

63,582

17,740

63,117

17,678

Amounts due from related parties, an associate, a joint venture, and a subsidiary that are neither past due nor impaired amounted to RM53,639,000 and RM53,558,000 (2013:

RM17,709,000 and RM17,678,000) for the Group and Company respectively.

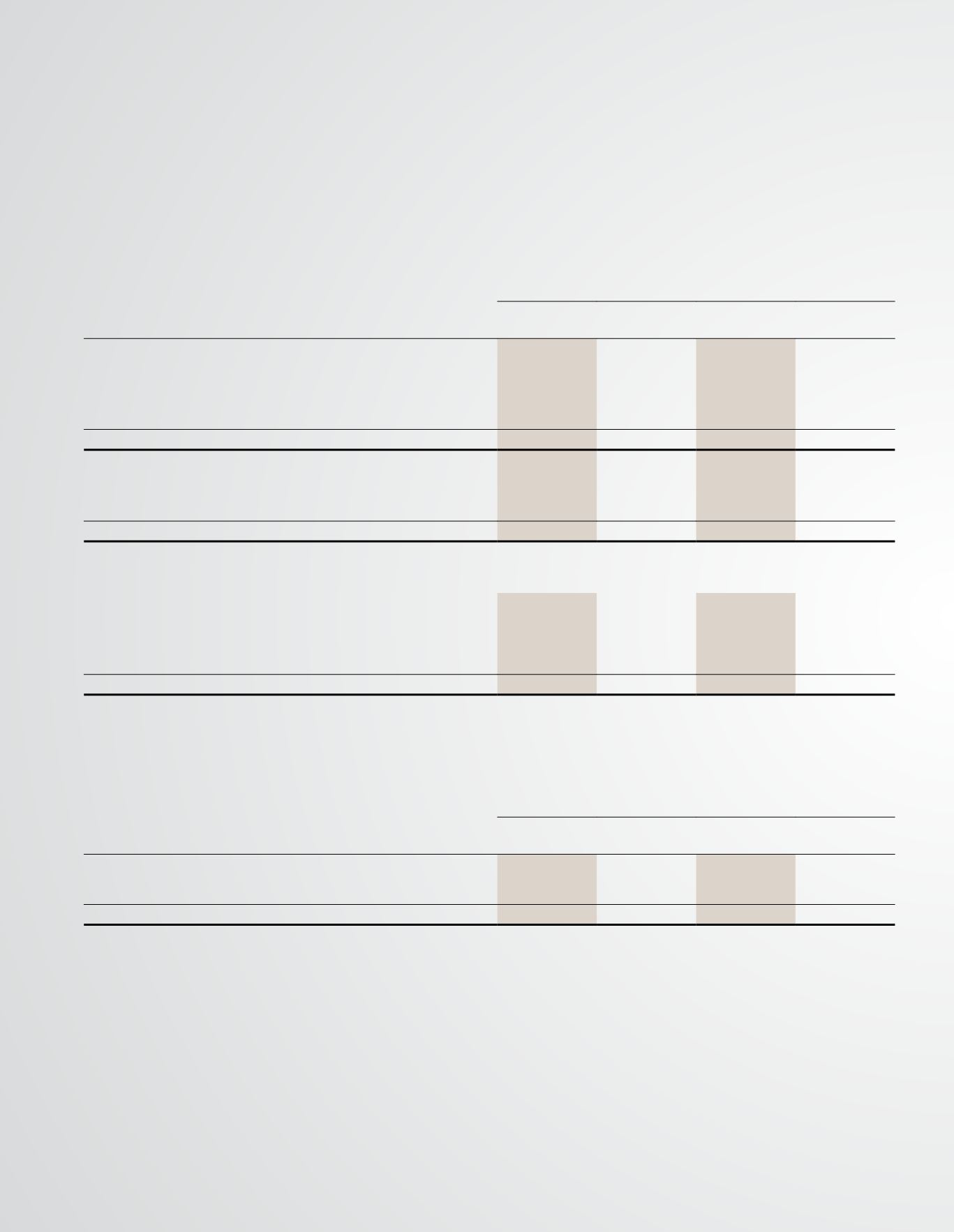

The ageing analysis that is past due but not impaired is as follows:

Group

Company

2014

RM’000

2013

RM’000

2014

RM’000

2013

RM’000

Less than 6 months

9,737

31

9,353

-

More than 6 months

206

-

206

-

9,943

31

9,559

-

The maximum exposure to credit risk as at the balance sheet date is the carrying value of the amounts due from related parties, an associate, a joint venture, and a subsidiary

mentioned above.

The Group and Company have not made any impairment on these balances as management is of the view that these amounts are recoverable as there is no history of default.