153

AirAsia X Berhad • Annual Report 2014

NOTES TO THE FINANCIAL STATEMENTS

AS AT 31 DECEMBER 2014

21 RECEIVABLES AND PREPAYMENTS (CONTINUED)

(b)

Other receivables (continued)

(iii)

Financial assets that are past due and/or impaired (continued)

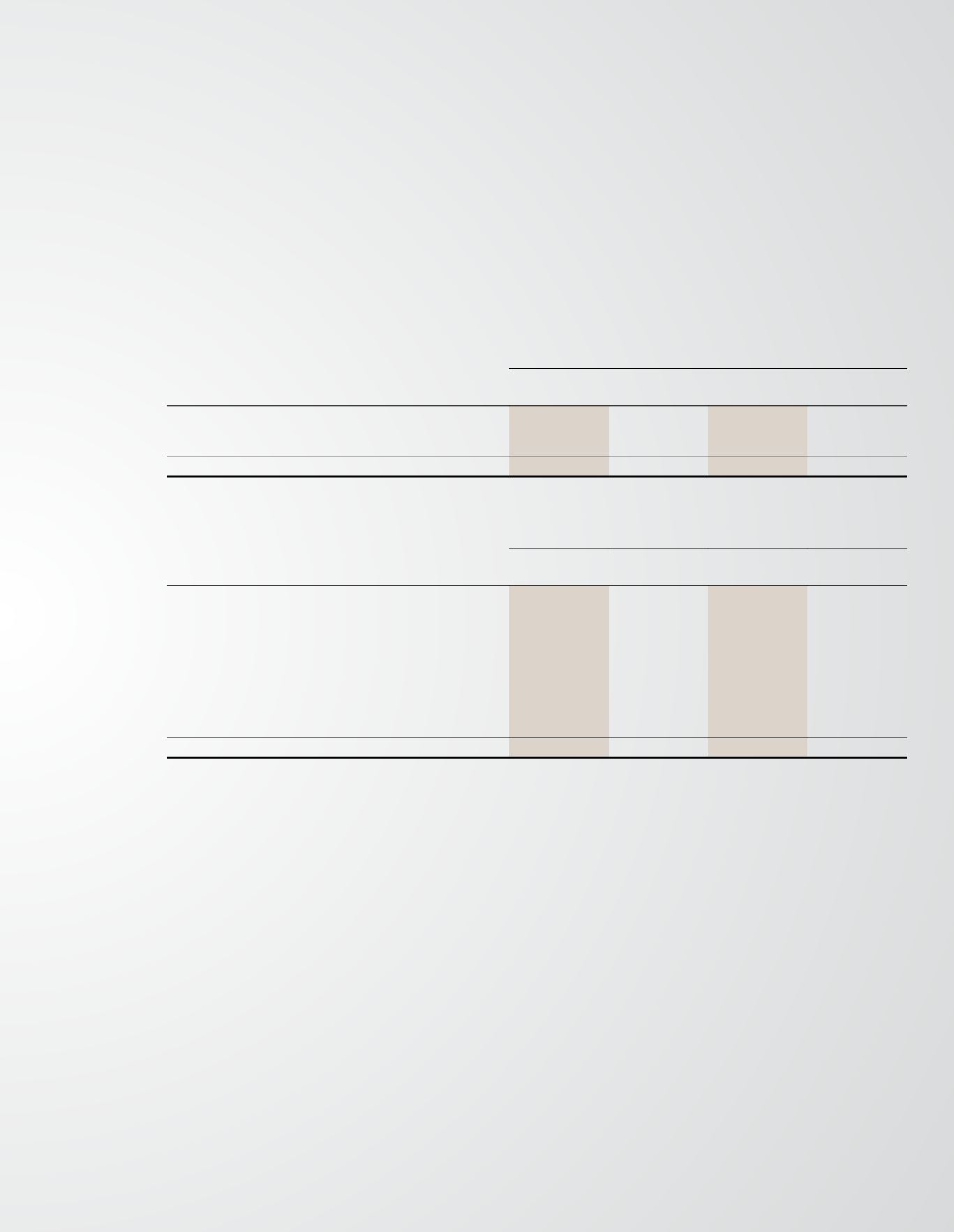

Movements on the allowance for impairment of other receivables are as follows:

Group

Company

2014

RM’000

2013

RM’000

2014

RM’000

2013

RM’000

At 1 January

1,245

693

1,245

693

Impairment (Note 6)

1,509

552

1,509

552

At 31 December

2,754

1,245

2,754

1,245

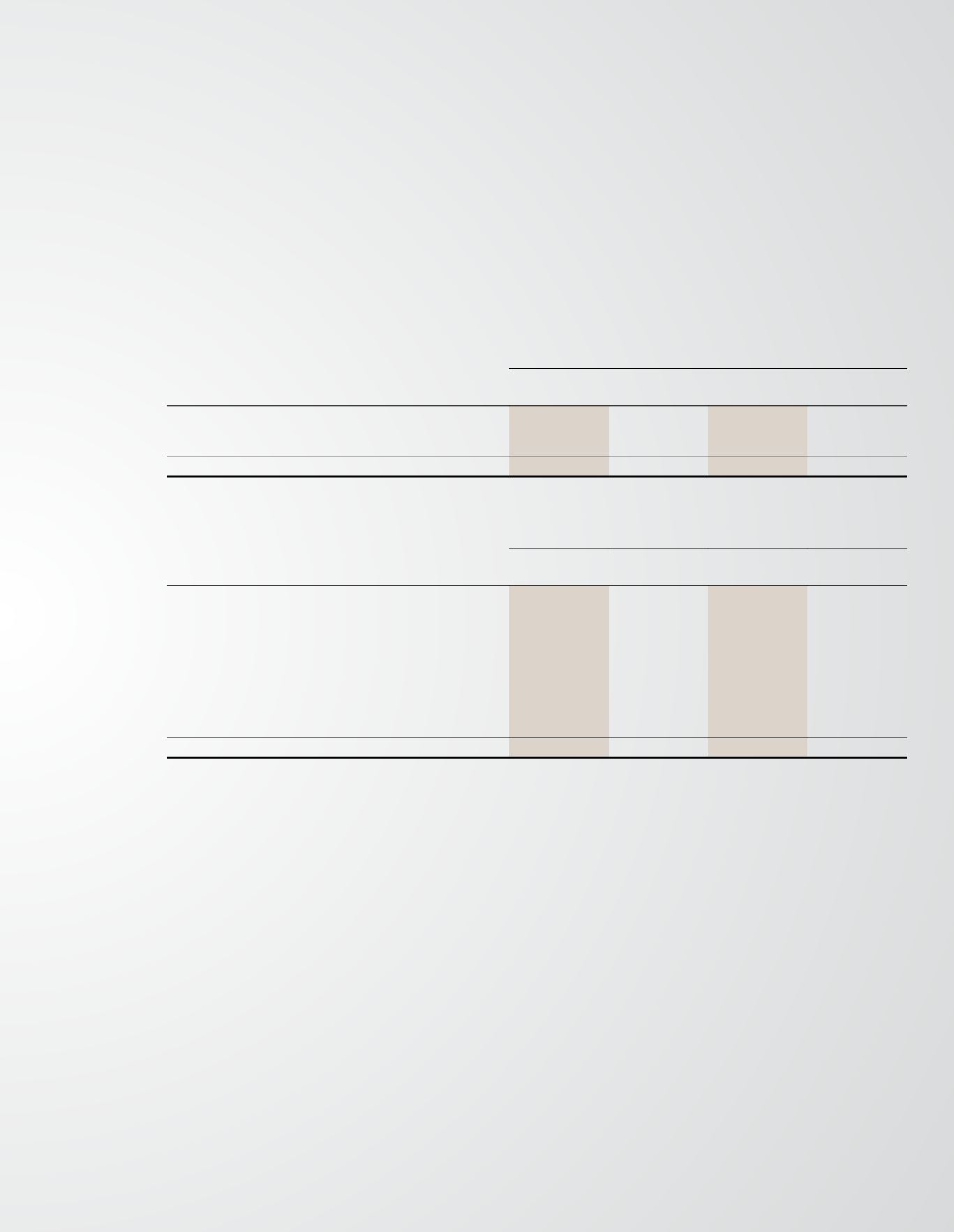

The currency profile of receivables and deposits (excluding prepayments) is as follows:

Group

Company

2014

RM’000

2013

RM’000

2014

RM’000

2013

RM’000

Ringgit Malaysia

17,585

22,530

17,585

22,530

US Dollar

186,711

74,268

186,711

74,268

Australian Dollar

17,006

14,859

16,933

14,824

Euro

241

85

241

85

Indian Rupee

1,502

1,414

1,502

1,414

New Zealand Dollar

112

62

112

62

Others

9,387

8,861

9,387

8,861

232,544

122,079

232,471

122,044

The other classes within trade and other receivables do not contain impaired assets.

The maximum exposure to credit risk at the reporting date is the carrying value of each class of receivables mentioned above. The Group and Company do not

hold any collateral as security.

Deposits of the Group and Company at the balance sheet date are with a number of external parties for which there is no expectation of default.

Other receivables include refunds of value-added tax receivable from the authorities in various countries in which the Group operates.

Included in prepayments are advances made for purchases of fuel, lease of aircraft and maintenance of engines.

Deposits include funds placed with lessor in respect of maintenance of the leased aircraft.

The carrying amounts of the Group’s and Company’s trade and other receivables approximate their fair values.