157

AirAsia X Berhad • Annual Report 2014

NOTES TO THE FINANCIAL STATEMENTS

AS AT 31 DECEMBER 2014

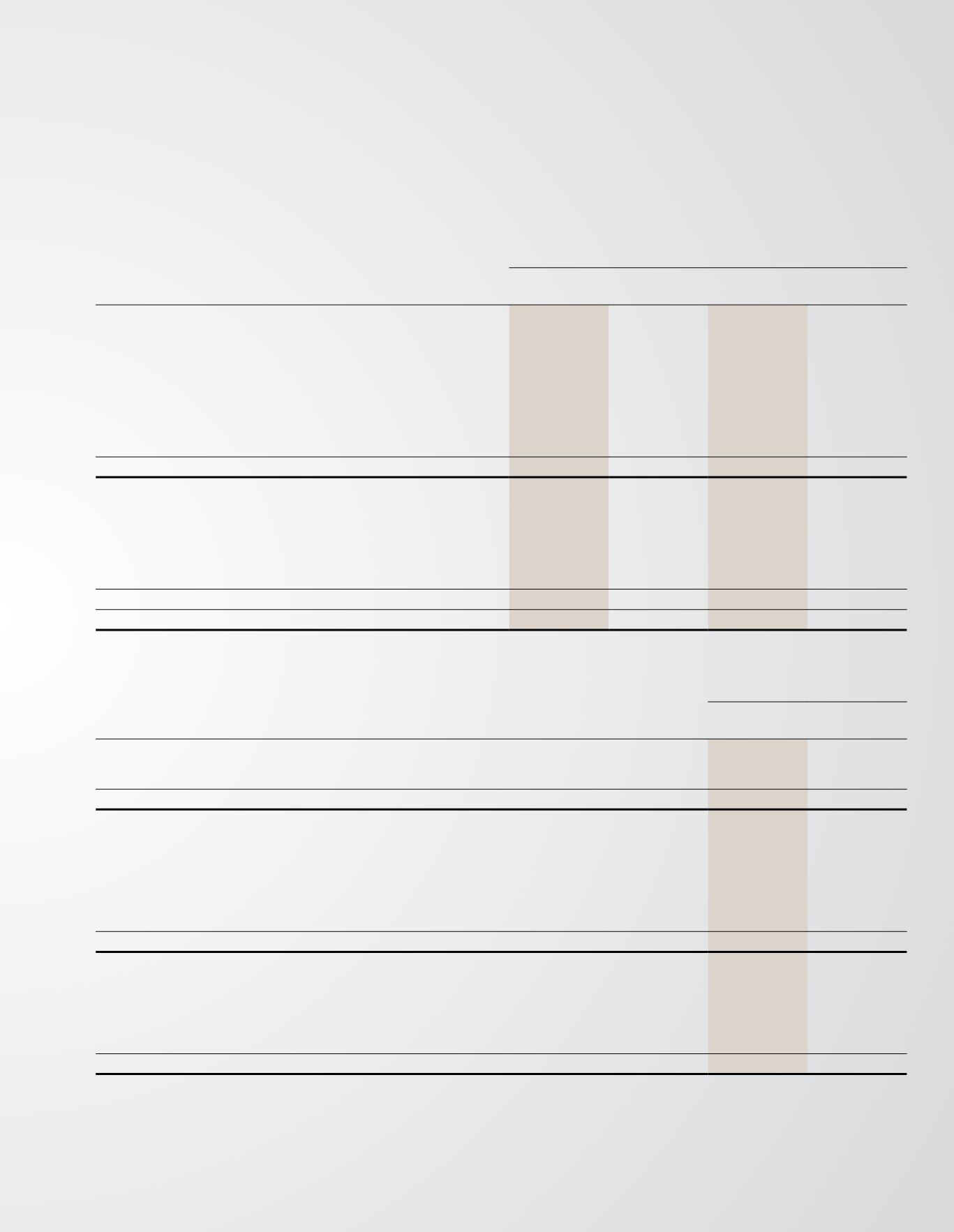

25 BORROWINGS

Weighted average rate of finance

Group and Company

2014

%

2013

%

2014

RM’000

2013

RM’000

Current

Secured:

- Revolving credit

4.19

3.56

316,026

261,185

- Term loans

4.24

4.68

162,202

184,674

- Hire purchase

2.80

2.80

17

21

Unsecured:

- Commodity structured trade finance

5.88

-

35,000

-

513,245

445,880

Non-current

Secured:

- Revolving credit

-

3.56

-

179,686

- Term loans

4.24

4.68

1,066,051

1,370,626

- Hire purchase

2.80

2.80

49

61

1,066,100

1,550,373

Total borrowings

1,579,345

1,996,253

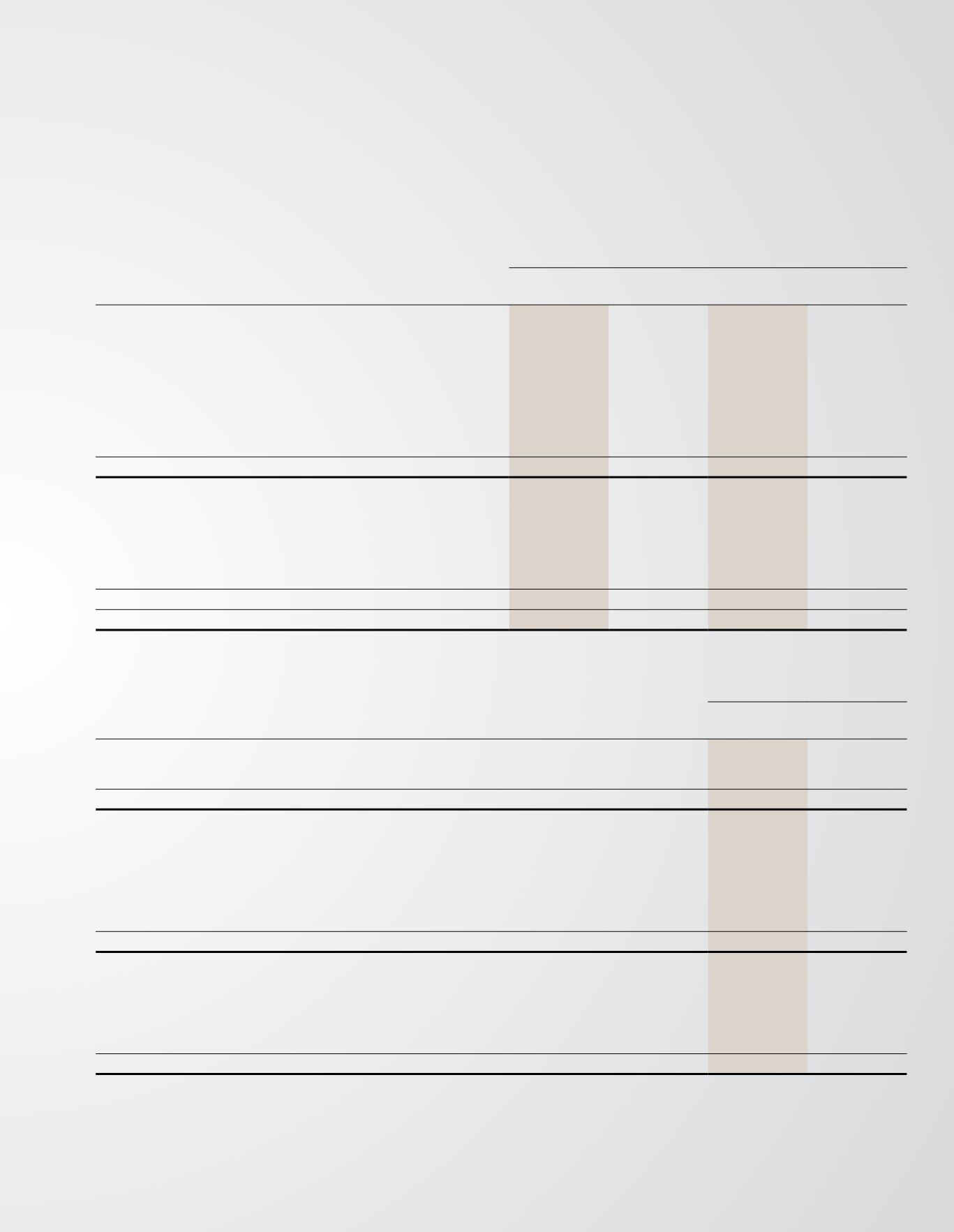

Total borrowings as at 31 December 2014 consist of the following banking facilities:

Group and Company

2014

RM’000

2013

RM’000

Fixed rate borrowings

1,228,319

1,534,835

Floating rate borrowings

351,026

461,418

1,579,345

1,996,253

The Group’s and Company’s borrowings are repayable as follows:

Not later than 1 year

513,245

445,880

Later than 1 year and not later than 5 years

648,858

899,680

Later than 5 years

417,242

650,693

1,579,345

1,996,253

The currency profile of borrowings is as follows:

Ringgit Malaysia

75,066

40,082

US Dollar

1,504,279

1,956,171

1,579,345

1,996,253