143

AirAsia X Berhad • Annual Report 2014

NOTES TO THE FINANCIAL STATEMENTS

AS AT 31 DECEMBER 2014

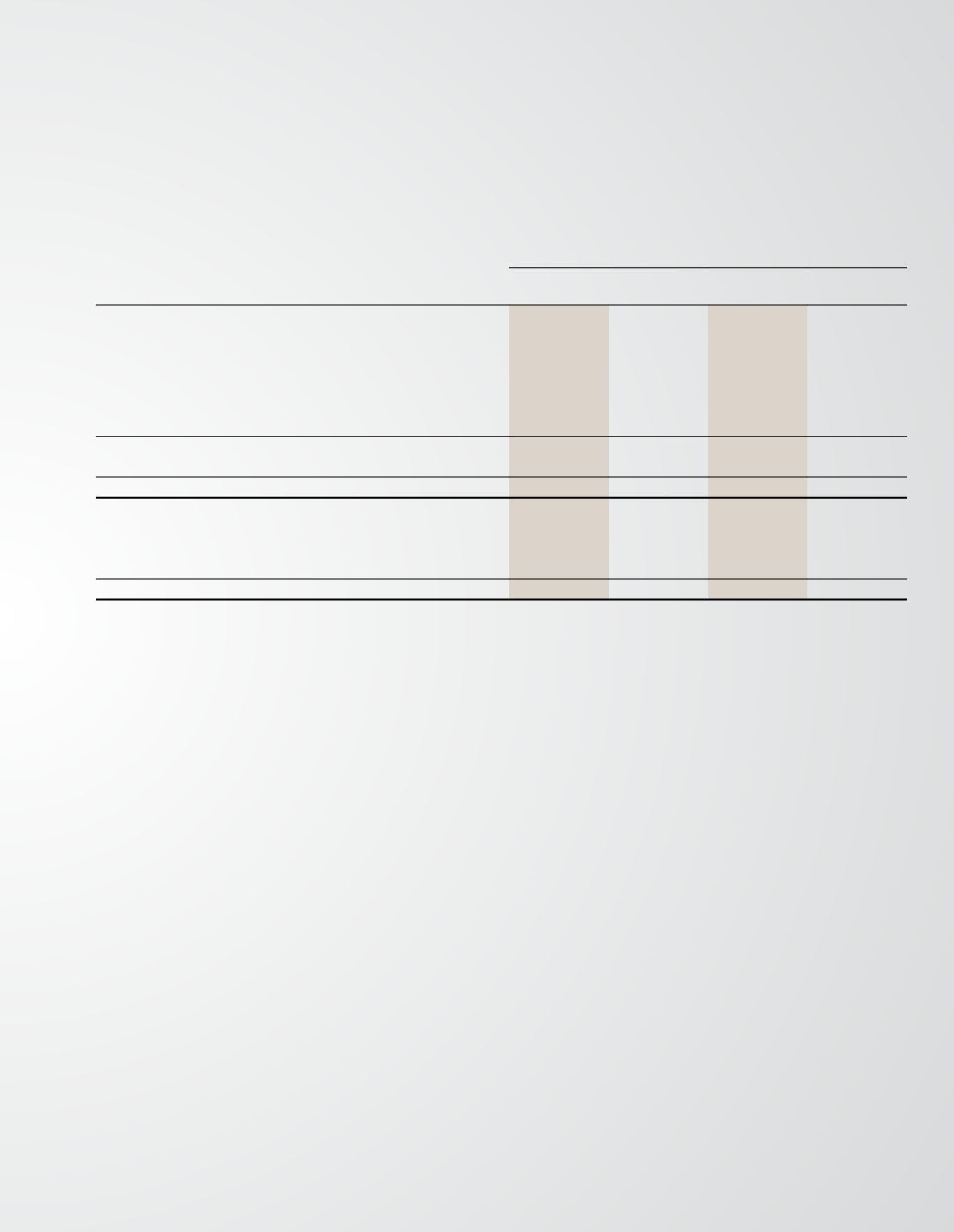

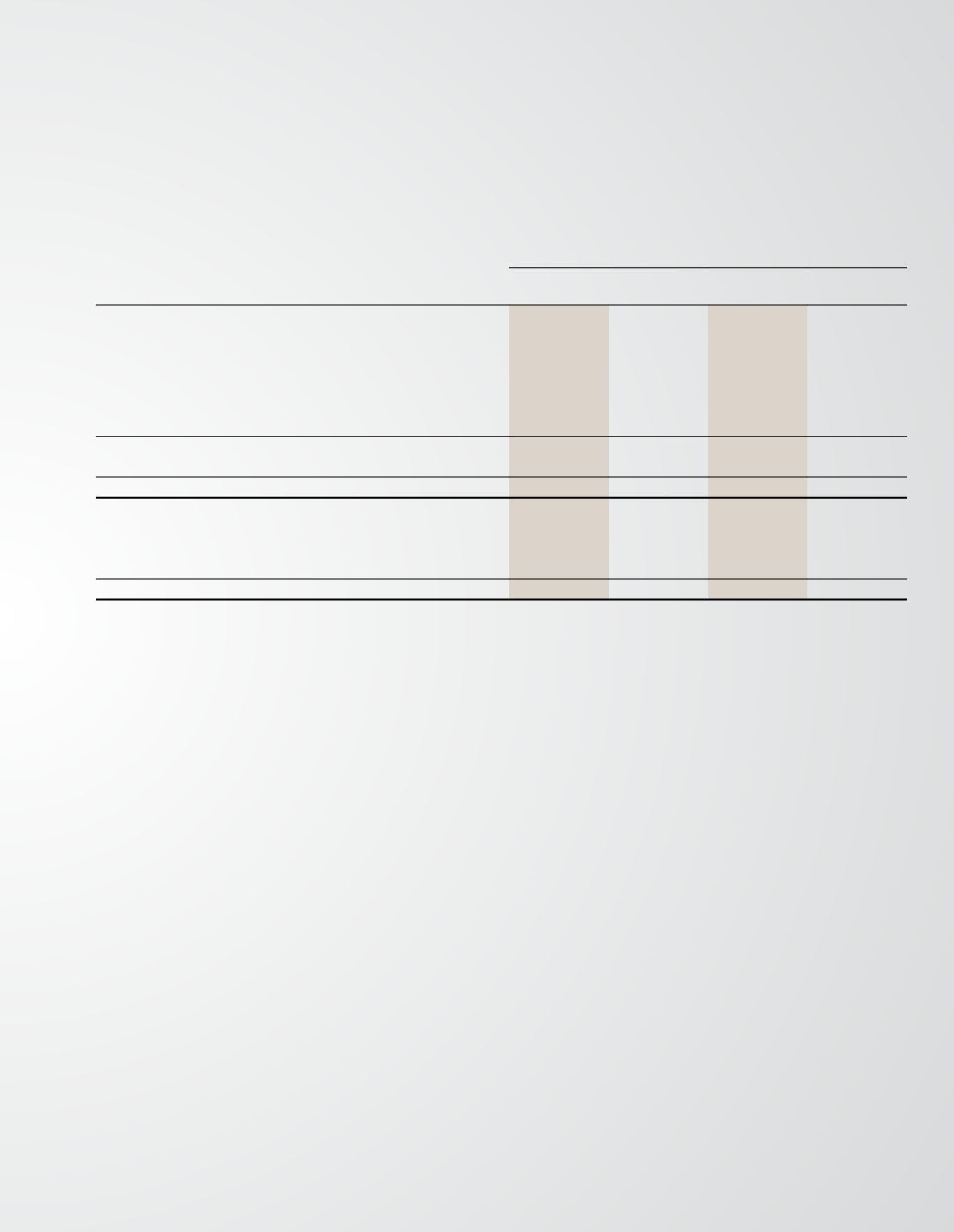

13 DEFERRED TAXATION (CONTINUED)

Group

Company

2014

RM’000

2013

RM’000

2014

RM’000

2013

RM’000

Deferred tax assets (before offsetting)

- Tax incentives

251,456

284,290

251,456

284,290

- Tax losses

59,263

16,598

59,263

16,598

- Property, plant and equipment

102,766

59,371

102,766

59,371

- Derivatives

31,414

-

31,414

-

- Others

894

360

894

360

445,793

360,619

445,793

360,619

Offsetting

-

(989)

-

(989)

Deferred tax assets (after offsetting)

445,793

359,630

445,793

359,630

Deferred tax liability (before offsetting)

- Unrealised foreign exchange differences

-

989

-

989

Offsetting

-

(989)

-

(989)

Deferred tax liability (after offsetting)

-

-

-

-

Deferred tax assets are mainly originating from unutilised tax incentives, unabsorbed capital allowances and tax losses carry forward which have no expiry dates. As disclosed

in Note 3 to the financial statements in respect of critical accounting estimates and judgments, the deferred tax assets are recognised to the extent that it is probable that

future taxable profits will be available against which temporary differences can be utilised. Estimating the future taxable profits involves significant assumptions, especially

in respect of regulatory approvals for prospective routes, aircraft delivery, fares, load factors, fuel price, maintenance cost and currency movements. These assumptions have

been built based on past performance and adjusted for non-recurring circumstances and a reasonable growth rate. Based on these projections, management believes that the

current non-time restricted temporary differences will be utilised and has recognised the deferred tax assets as at end of the reporting date.

The Ministry of Finance has granted approval to the Company under Section 127 of Income Tax Act, 1967 for income tax exemption in the form of an Investment Allowance

(“IA”) of 50% on qualifying expenditure incurred within a period of 5 years commencing 1 September 2014 to 31 August 2019, to be set off against 50% of the statutory income

for each year of assessment. Any unutilised allowance can be carried forward to subsequent years until fully utilised. The amount of income exempted from tax is credited to

a tax-exempt account from which tax-exempt dividends can be declared.

14 DEPOSITS ON AIRCRAFT PURCHASES

The deposits on aircraft purchases are denominated in US Dollar and are in respect of pre-delivery payments on aircraft purchases. Pre-delivery payments constitute instal-

ments made in respect of the price of the aircraft and are deducted from the final price on delivery.

The deposits as at 31 December 2014 are in respect of aircraft purchases which will be delivered from January 2015 to May 2025.

During the financial year ended 31 December 2014, the Group and Company capitalised borrowing costs amounting to RM10,054,000 (2013: RM10,460,000) on qualifying

assets. Borrowing costs were capitalised at the rate of 4.90% (2013: 5.48%) per annum.

15 OTHER DEPOSITS AND PREPAYMENTS

Other deposits and prepayments include prepayments for maintenance of aircraft and deposits paid to lessors for leased aircraft. These prepayments and deposits are denom-

inated in US Dollar.