142

AirAsia X Berhad • Annual Report 2014

NOTES TO THE FINANCIAL STATEMENTS

AS AT 31 DECEMBER 2014

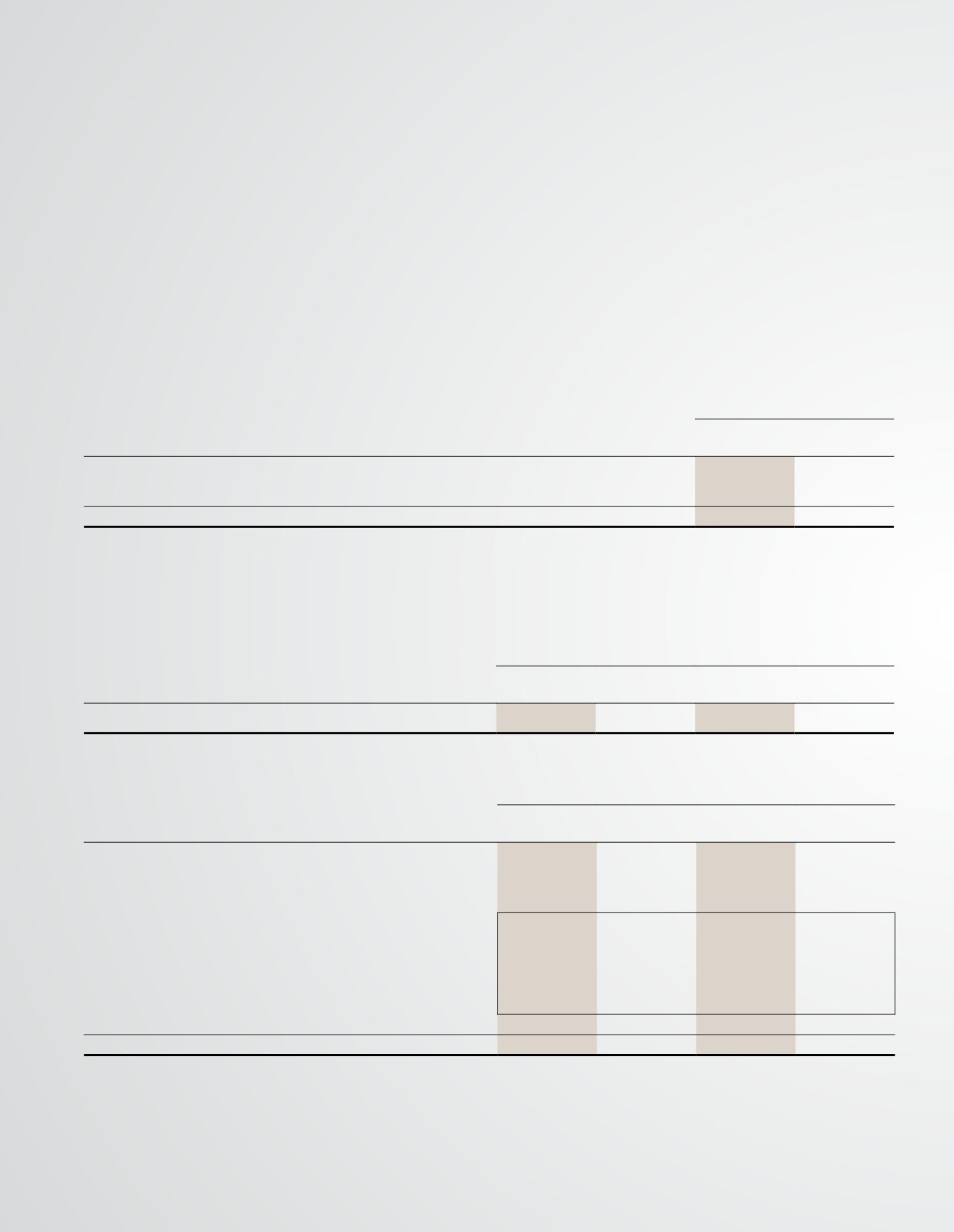

12 PROPERTY, PLANT AND EQUIPMENT (CONTINUED)

Included in property, plant and equipment of the Group and Company are aircraft pledged as security for borrowings (Note 25) with a net book value of RM1,682 million (2013:

RM2,066 million).

The beneficial ownership and operational control of certain aircraft pledged as security for borrowings rests with the Company when the aircraft is delivered to the Company.

Where the legal title to the aircraft is held by the financiers during delivery, the legal title will be transferred to the Company only upon settlement of the respective facilities.

The net cash outflow for the acquisition of property, plant and equipment during the financial year is as follows:

Group and Company

2014

RM’000

2013

RM’000

Acquisition of property, plant and equipment during the financial year

418,653

1,069,949

Less: Deposits on aircraft purchases paid in the previous financial year

(66,192)

(187,284)

352,461

882,665

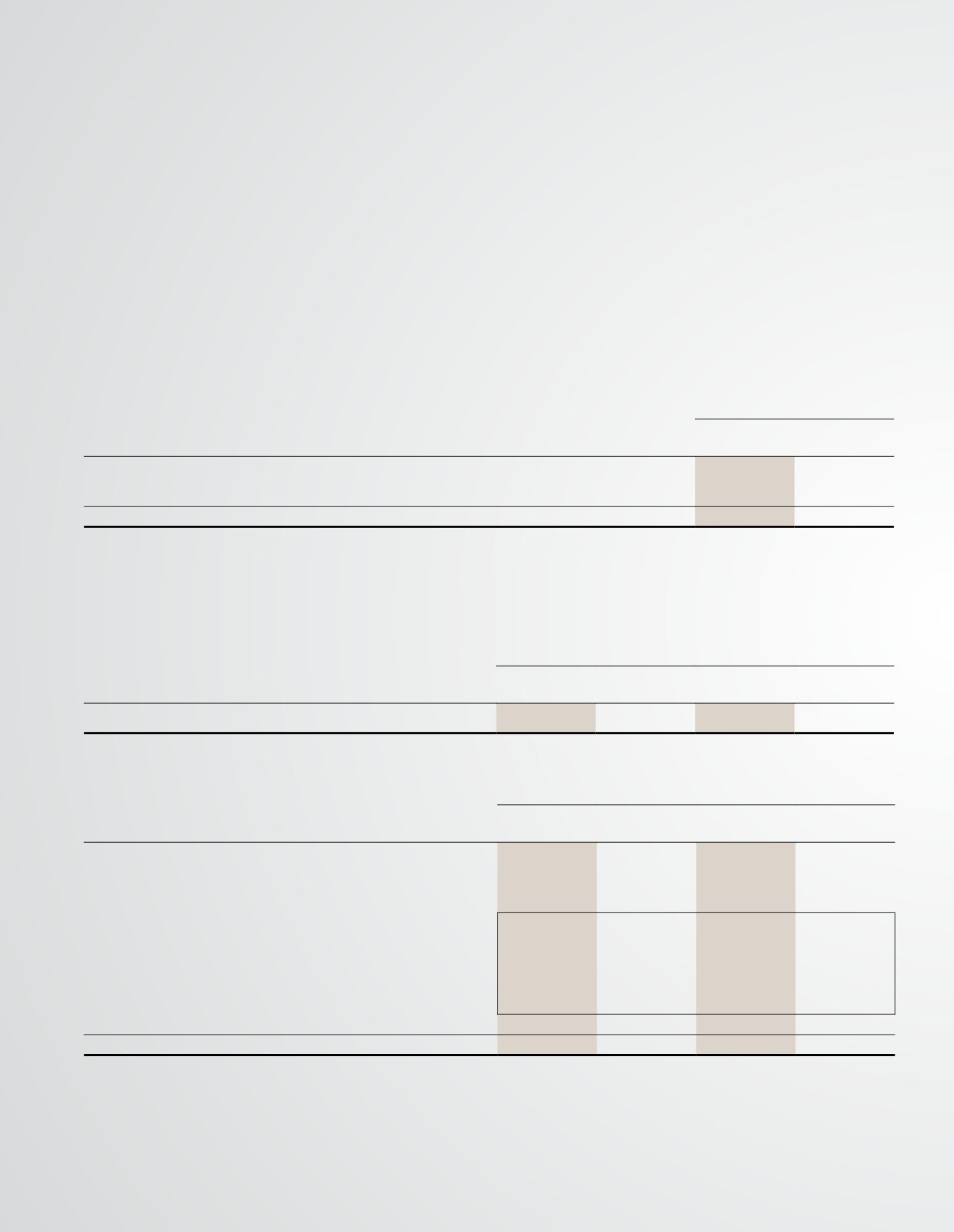

13 DEFERRED TAXATION

Deferred tax assets and liabilities are offset when there is a legally enforceable right to set off current tax assets against current tax liabilities and when deferred taxes relate

to the same tax authority. The following amounts, determined after appropriate offsetting, are shown in the balance sheets:

Group

Company

2014

RM’000

2013

RM’000

2014

RM’000

2013

RM’000

Deferred tax assets

445,793

359,630

445,793

359,630

The movements in deferred tax assets and liabilities during the financial year are as follows:

Group

Company

2014

RM’000

2013

RM’000

2014

RM’000

2013

RM’000

At beginning of financial year

359,630

234,840

359,630

234,840

Credited/(charged) to income statement (Note 10):

- Property, plant and equipment

43,395

27,058

43,395

27,058

- Unrealised foreign exchange differences

32,403

(1,568)

32,403

(1,568)

- Tax losses

42,665

(691)

42,665

(691)

- Tax incentives

(32,834)

99,899

(32,834)

99,899

- Others

534

92

534

92

86,163

124,790

86,163

124,790

At end of financial year

445,793

359,630

445,793

359,630